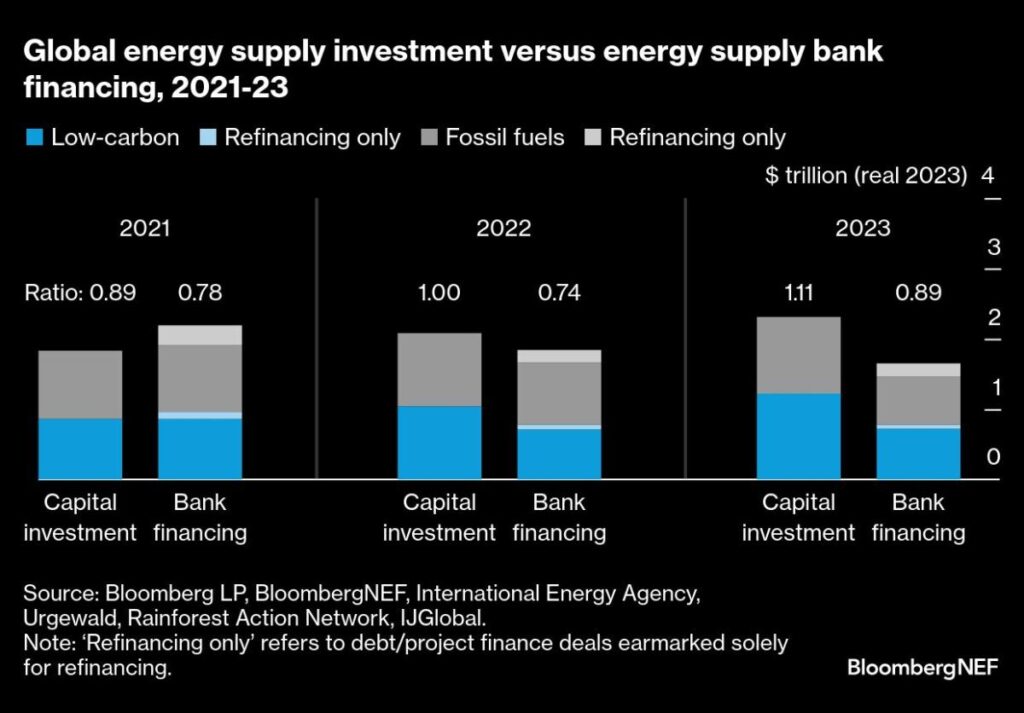

The world’s largest banks are falling short of their promises to combat climate change, with limited progress in low-carbon funding. According to BloombergNEF (BNEF), the energy supply bank ratio (ESBR) needs to reach 4 to 1 by 2030 to adequately tackle climate issues. As of late 2023, the ESBR was only 0.89 to 1, up slightly from 0.74 in 2021. Despite some positive trends, including a drop in fossil fuel investments, overall bank funding remains insufficient to meet the goals of achieving net-zero emissions by mid-century. Major banks like JPMorgan and Citigroup continue to support fossil fuel clients while claiming to back a transition to low-carbon energy. Additionally, BNEF’s analysis shows that funding for fossil fuels decreased in 2023, yet the existing levels of investment in hydrocarbons still significantly overshadow renewable projects. The report highlights a need for greater accountability among banks regarding their environmental impact, as many omit emissions data related to their financing activities.

Source link