The article by Wolf Richter discusses the state of U.S. Treasury yields, focusing on foreign demand for financial securities. It notes that, despite fluctuations, foreign investors continue to actively purchase U.S. debt, with the latest auction revealing an increased interest in 10-year Treasury bonds (18.4% purchased compared to 11.9% in March).

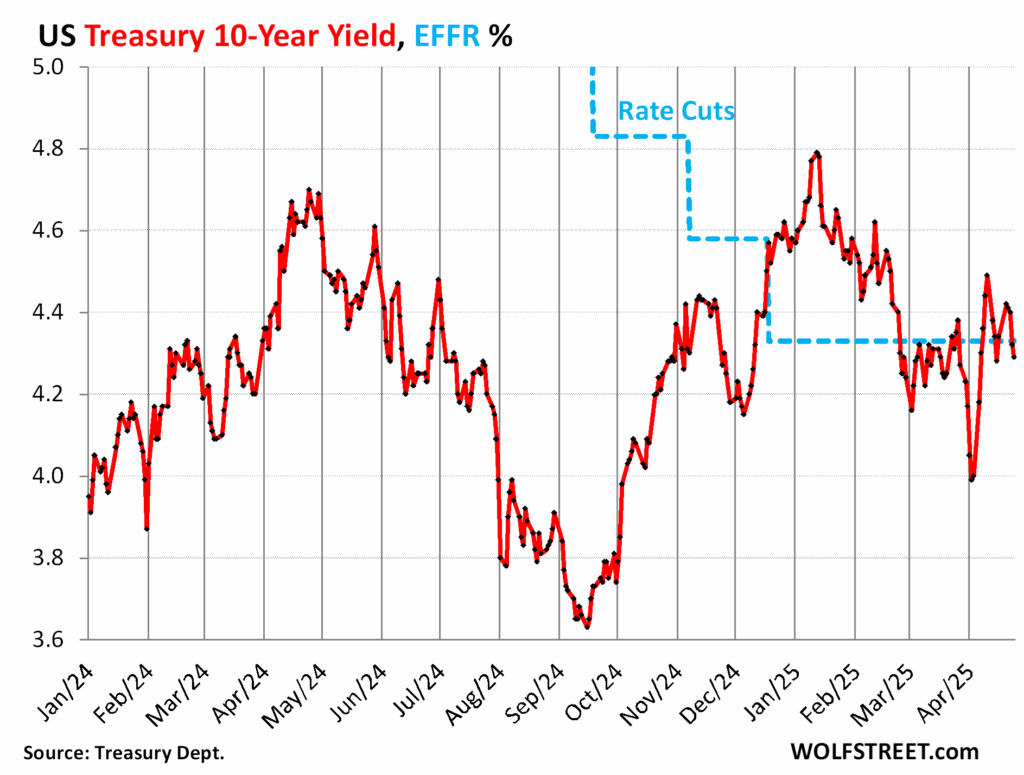

Treasury yields are shown to be closely aligned with the effective federal funding rate (EFFR), currently at 4.33%. The 30-year financial yields have reached 4.74%, reflecting heightened risks compared to 10-year securities. Despite concerns over inflation, demand remains robust for U.S. Treasury securities, driven by relatively low yields.

The article also discusses the broader implications of yield curves and interest rates. Short-term yields are tethered to the Federal Reserve’s policy rates, showing minimal movement, while longer-term yields have rebounded from lows but are still below earlier highs. The overall yield curve indicates a notable drop in middle-term yields, leading to deeper inversion.

Additionally, it addresses the U.S. dollar’s performance, with the dollar index falling from 110 in January to around 100, indicating a strategic move to support U.S. exports while managing inflation. The article concludes that demand for Treasury securities remains strong, even as rates fluctuate, emphasizing the historical spread between Treasury yields and mortgage rates as a factor in the current economic climate.

Source link